Compensation Packages in Residential Construction

Much of what employers know about compensation plans is based on how they were compensated by the business owners they worked for. And those business owners likely copied how their own employers treated them.

Which leads to owner/operators spending far too much time concerned with how much their employees are costing them instead of focusing on how to maximize their investment in their teams.

Not every employee steps into a role knowing exactly what they need to do or how to do it. More often than not, it's a learning curve, and the mistakes or extra costs that come with that curve can be frustrating when you're only concerned with the bottom line.

But each individual you hire is an investment in your company's future, and you need to change your mindset about how you compensate them for their work because good people earning good money feel motivated and appreciated.

That means approaching employee compensation from a "team development" perspective and creating a well-planned comprehensive direct compensation package for your employees rather than making it an ad-hoc decision.

For many employers, that shift will feel like unchartered territory, but it's critical for your success in building a team that feels rewarded fairly for its hard work.

Understanding What Drives People

We are all conditioned to think that money is the biggest motivator in a person's life. While it is key to covering basic needs like food, clothing, and shelter, and, one could argue, the main reason people go to work, it's not the only motivating factor for determining why an employee chooses a job.

Or, more importantly, stays at that job.

In Daniel Pink's book, Drive: The Surprising Truth About What Motivates Us, he talks about the three types of motivating systems that humans rely on:

Motivation System 1 - This is a survival-based system, one that kicks in when you're in a survival situation (avalanche, earthquake, etc.).

Motivation System 2 - This is the current system that has been in place for thousands of years. It is a "carrot and stick" rewards/consequences method.

❌ Do this right, you get a pat on the back.

❌ Do this wrong, you get the belt.

Motivation System 3 - This involves the awareness that people can achieve great things if their environment is conducive to their growth.

✔️ Autonomy

✔️ Mastery

✔️ Purpose

The last one is the set of tenets that motivates people towards greatness.

But when it comes to paying a base salary, most employers are stuck in the "carrot and stick" method, which only serves to motivate employees for a short time - usually, the amount of time it takes to "level up" to the next pay grade.

A solid compensation package that includes both base pay and bonus plans is important for construction companies looking to build a great company culture that attracts and retains the best talent. However, taking that one step further and structuring your team's roles to align with the tenets of autonomy, mastery, and purpose reinforces our internal validation system and creates an even stronger alignment with your team than just great pay alone.

Focus on Creating a Career Roadmap

An often overlooked item in the quest to build a compensation strategy is the concept of tying it to a career roadmap, where the employee can see the trajectory of growth in their experience, knowledge, status, and pay grade.

Creating a career roadmap for your team means working through a process where you determine the following things for each position in your company:

The outcomes of the role (maximum of 5).

The functional areas of the role that employees can affect the outcomes.

The specific job functions (SJFs) that they perform to reach the outcomes.

This helps show an employee what their growth pathway looks like, which ties into motivating them based on purpose and pursuit of mastery and outlines what they need to be doing in their roles on a daily basis.

Framing Your Compensation Plan

Each employee in your company performs different tasks, bringing a unique value offering to your business, and their compensation package should reflect that.

Often, companies tend to apply cookie-cutter employee compensation plans that focus on X dollars for X role or level. But that method doesn't account for each person's individual strengths or talents.

The best types of compensation plans look at the dynamics of each position and the value that each employee brings to that role - and to the company overall.

Separate Your Team into Leaders and Performers

When determining what your compensation plans should look like, it helps to start by separating your team into leaders and performers, which we often think of as our management roles versus our front-line or on-site personnel.

This is helpful as it displays what the career trajectory can look like for each person on your team. For example, a carpenter can see the path of stepping into a Lead Carpenter role and then eventually a Superintendent and even Project Manager someday.

Then you need to look at each role within those two groups and define the value each position brings to the company. Using that criteria, you can then determine a compensation amount for each role.

Measuring Value

When determining the compensation level for a role, it helps to have a set of criteria to judge the role against so that each employee's salary is based on the same merit.

Consider each role and award points based on the criteria below. The higher the score, the higher the salary and potential profit sharing in incentive plans.

Education

Consider whether formal or other education is required to perform the role. List the different types of formal education and rate them on a scale from 1-4:

High school

Trade School (Ticket/License)

Professional Training (Sales, Project Management)

University/College Degree/Certificate

Experience

How many years of experience does someone need to qualify for this position?

0-2 years

2-5 years

5-8 years

8-10+ years

Training

How much time will it take to train someone to become proficient in their role?

1-3 months

3-6 months

6-12 months

> 12 months

Time Horizon

How far ahead does this team member need to plan to achieve the results they are accountable for:

1. Daily to Weekly

2. Weekly to Monthly

3. Monthly to Quarterly

4. > One Year

Complexity

An expression of the size and type of the job:

Executional (carries out concrete tasks)

Operational (follows a process)

Tactical (determines the best method)

Strategic (establishes plans, objectives, policies)

Here is how this might look in chart form:

Defining Compensation Ranges

Once you've categorized and assessed each role, it's time to create salary ranges for each position level in the company based on these three things:

Competency in the role

A good way to think about someone's competency in a role is to picture the gas tank in your truck. At 100% full, the truck can perform at a high level for a sustained period of time. Every person in every role in any business is typically not at 100% competency, particularly when they start that role (or are internally promoted to it).

Sustained performance

Let's be honest, no one comes to work every day and crushes it, business owners included. We are human, and along with that comes peaks and valleys in performance. But the question is, how consistent is an employee on an ongoing basis? This concept is particularly important in avoiding the "Honeymoon Period," which we'll discuss later.

Relative business and market economics

The final criteria when determining ranges for compensation comes from the internal thoughts business owners have: what will the market bear and what are my competitors paying. These are common questions, and they certainly are worth asking.

Often, most business owners will focus more heavily on relative business and market economics when they design compensation packages and do not put enough emphasis on the individual's competency and performance.

While current market economics and the state of your business do play a significant role in what you can bill out a carpenter or superintendent at, it shouldn't be the main driver in your decision-making process.

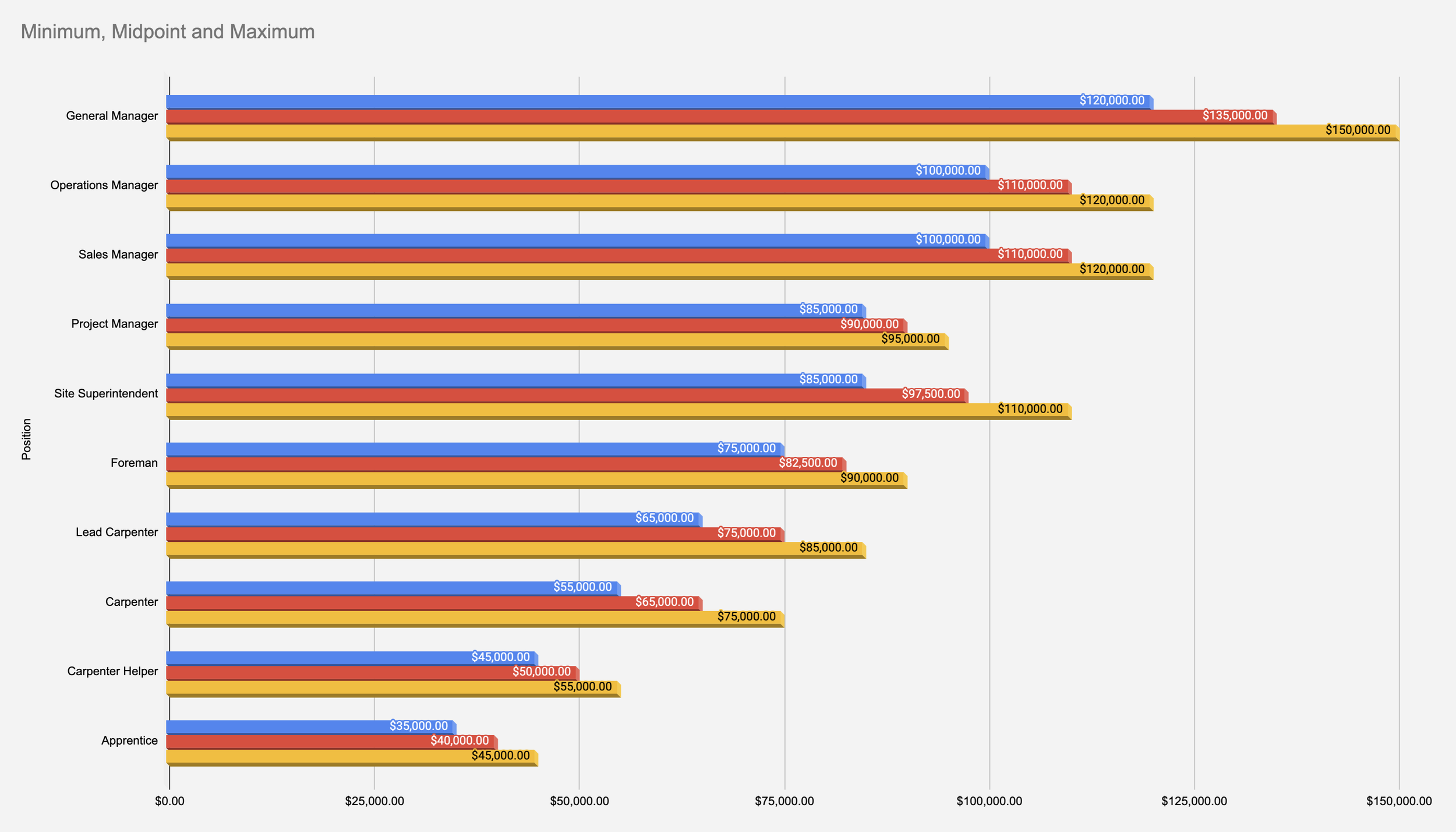

As an example, this might be what this looks like in chart form with typical positions we see in remodeling and custom home-building businesses:

And the compensation can be displayed in graphical form like this:

And the compensation can be displayed in graphical form like this:

Practice Fairness, Not Sameness

The reality is that every company likely has two employees that perform the same role. However, they don't perform at the same level. Which begs the question: should they be compensated the same?

The short answer is no.

The longer explanation is that if you're going to assign a different pay structure to full-time employees in the same role, it should be done based on the value you assign to each individual.

For example, you might have two Superintendents who manage projects for you, but one can handle $3.5 million per year, whereas the other can only manage $2 million. This is an example of where the employee managing more revenue brings more value to your business and should be compensated at a higher level.

It's important that you share the judging criteria with your teams so they do not make assumptions about why someone is compensated higher than them and feel that they are being unfairly treated.

Recognize A-Players & Reward Them

Not everyone on your team is going to be an all-star, and while you can work with your teams to coach them on becoming a high performer, it's important that you recognize and reward the key employees already at that level.

A-Players can change a business from one that is average to one that is exceptional. They tend to have an "Owner's Mentality" and treat the business's money and relationships as if they were their own.

They are growth-minded and need to have a role that is challenging. A good way to keep them engaged is to tie their compensation benchmarks to their bonus pool.

For more information on developing a bonus pool, click here.

Four Things to Avoid When Creating a Compensation Plan

Creating an effective compensation plan is crucial for attracting, retaining, and motivating employees. And while you're focusing on everything you should include in that plan, it's important to highlight a few things to watch out for.

Incentivizing the Wrong Behaviors

It's not uncommon to include incentive programs in your compensation structure, like including a sales quota for your sales team members. But when you're doing that, you need to ensure that the incentivization component will drive the right results.

A sales quota, for example, becomes problematic if the salesperson is selling the wrong types of projects to the wrong clients at the wrong margin - all so they can hit their monthly quota.

Understanding that each employee's performance needs to adhere to both the position and company standards outlined in their Position Agreement helps ensure that you are incentivizing your team correctly.

Avoiding the “Honeymoon Period”

Everything in life is more fun when it's shiny and new. But eventually, the "newness" wears off, and things go back to the way they were.

That phenomenon is called the "Honeymoon Period," and it happens in the construction industry, too - especially when it comes to rewarding performance with a raise. Right after receiving that raise, an employee often performs at a higher level because they're still excited about the increase in salary.

But then slowly - usually within six weeks, they return to their normal output, attitude, and performance and need new motivation to up their game.

Avoiding the honeymoon period is hard because, without a consistent challenge, most of us will fall into the mind trap of expectation versus privilege. This is why it's critical not to dangle incentive compensation in front of employees because it's often hard for them to stay motivated.

Instead, follow a clear, transparent, and consistent compensation plan with key performance indicators as described above. This will ensure that your teams and you are aligned with what performance they are being measured against and what this means for their compensation level.

Dealing with “Management Debt”

Do not subscribe to "management debt," which is a phenomenon similar to what the software world calls "technical debt." This is when you make a quick fix in software that plugs the hole in the bucket, but eventually, there are too many holes in the bucket, and the system crashes.

The same phenomenon can happen in the business world when you use money to negotiate with employees who threaten to leave if they don't get the compensation they want. Increasing someone's compensation for employee retention purposes becomes a zero-sum game very quickly because that employee will always want more.

It can also be problematic if other employees learn about it and start actively seeking competitive offers to use as leverage in wage negotiations or because they feel that if employee A is getting a raise, they should be too.

All of this becomes an inordinate waste of everyone's time and takes their minds off of what they should be focusing on – their job.

Don’t Associate Tenure with Annual Raises

Employees often go into an annual review expecting a raise, and often it's not based on performance or merit, but simply "loyalty." Generally speaking, everyone's cost of living increases each year, so adjusting your employees' salaries to account for inflationary changes is always a good idea.

However amounts higher than baseline inflation should be based on a proper set of criteria that evaluates the individual's performance and not just on tenure.

Compensation is More Than Just a Salary

When it comes to employee compensation, many business owners stop at the point where they're paying a wage - one that often reflects what they feel is appropriate based on the job description, the employee's skill level, and what they hear other general contractors are paying their teams.

And when employees ask you for above and beyond that arbitrary amount, it can put a lot of pressure on you because labor costs already account for a large chunk of your cost of goods, and it feels like it's always getting more expensive.

However, hiring and retaining top new talent for your remodeling or custom home-building business is critical, and it means thinking outside the box and finding other ways to compensate your employees, thereby changing your compensation philosophy.

Alternative Forms of Compensation

Compensation isn't just about weekly wages, and while that might be the point that employees are focused on, it's also important to show what else you bring to the table as an employer during the hiring process.

Not every employee will take advantage of those indirect compensation benefits such as health insurance or retirement plan contributions, but offering them is important because it shows that you recognize the value your team brings to your business.

Alternate forms of compensation and employee benefits can be broken down into two categories: taxable and non-taxable. Let's explore both.

Taxable Benefits

The most common form of alternative compensation is a bonus structure that typically involves a cash payout based on specific metrics, such as employee performance and overall business results throughout the year.

These bonuses are usually reserved for the holidays or tied to annual performance reviews.

And while cash bonuses are always king, it's important to note that they may not actually be as enticing or beneficial as they seem.

Cash bonuses are a taxable benefit to both the employee and employer. A taxable benefit is one that provides the employee with an economic benefit that can be measured in money.

That means they are included in an employee's gross income, and those benefits are subject to income tax withholding and employment taxes by both the IRS and Canada Revenue Agency, which decreases the actual value of the benefit to the employee.

Non-Taxable Benefits

Non-taxable benefits are both physical items and services that are not subject to taxation and do not need to be added to an employee's gross income, which, in many cases, makes them easier for an employer to offer and makes your overall compensation package more robust.

Tool Allowances

Every employee performs best when they have the right tools at their disposal. Ensuring that your teams are set up with everything they need to do their jobs efficiently and effectively can go a long way in retaining them.

In Canada, tool allowances are generally allowed up to a maximum of $500. In the US, reimbursements to current employees for tools purchased that are directly related to a project they are working on while under your employ can be considered a non-taxable benefit to them.

Outside of personal tool allowances also is the concept that providing exceptional tools and environments like a wood shop to utilize while employed by you, can be seen as an added perk of working in your company.

Industry Discounts

Offering your employees the opportunity to take advantage of discounts you receive from other industry vendors for their personal use is generally a non-taxable benefit. This can be for building materials, safety gear, and tools.

Education

Sometimes an employee's growth within a company requires them to gain additional skills or knowledge. Encouraging them to pursue those opportunities without going out of pocket can foster additional loyalty and be an attractive part of your overall compensation package.

Both the US and Canadian governments recognize educational stipends as non-taxable benefits in certain situations. For example, if employers cover the costs for skilled training or other related educational courses up to a certain amount for employees that directly impact their ability to perform, that's considered a non-taxable benefit.

Supplying Company Vehicles

I often talk with remodelers and custom builders about whether or not they should provide vehicles for staff members and how that would work as a benefit in their favor.

On the upside, providing a company vehicle ensures that your team members always have a solid means of transportation to and from work and keeps them from having to pay for gas and maintenance. And because you, as the employer, are paying for and providing the vehicle, there is no tax implication for your employee.

The downside to this benefit is that it does involve a larger amount of risk and investment on your part because company vehicles increase your overhead costs, and because there can be insurance-related stipulations.

Many insurance companies don't appreciate company vehicles being used for personal transportation and require fleet insurance which usually stipulates that company-insured vehicles cannot be used for personal travel. That poses a problem for employees using those vehicles to travel to and from their homes to work.

Providing a Company Gas Card

The best types of non-taxable benefits are those where the employer covers the costs upfront. This avoids making employees go out of pocket and wait for reimbursement, and it alleviates the issue of going over established reasonable tax guidelines for reimbursable benefits.

Employee gas cards are a perfect example of how you can provide a measurable benefit to your team without increasing their taxable income.

Gas prices have been reaching all-time highs for a few years now, and that cost can be prohibitive for some people, especially when they often find themselves on the road for work.

Providing a company gas card that your team members can use to cover the fuel cost for work can be worth up to $15,000 a year and is tax-free for everyone.

If you do implement a company gas card program, be sure to create a clear policy for how and when they are used to avoid them being misused or abused.

Mileage Reimbursement for Personal Vehicles

The good news about this option is that it's a cost directly connected to your employees. So it's treated as a cost of goods and is billed to the appropriate client, not as an overhead expense, and generally speaking, it doesn't impact your bottom line.

And it's an easy process to implement. Both the United States and Canadian governments set reimbursement rates based on mi/km and the going rate of gas, which you can find on their respective IRS or CRA websites.

Include a clause in your client contract's "Cost of Work" section that states you are passing through the government-approved rate per mi/km for team members.

Carry a line item in your estimates for mileage on the project.

Encourage your team to submit their mileage each week so you can include this in your billings to your clients.

There are specific parameters for reimbursement to your employees for mileage. Make sure to follow these guidelines so you and your employees can take advantage of this non-taxable benefit.

These are a handful of things you can consider in terms of alternative compensation methods, but the sky is truly the limit. In the Google/Amazon workplaces of the world, they offer gyms, leisure centers, and catered lunches. While most of that is impractical, consider variations, like offering your employees to participate in a group health club membership program as part of their benefits package and providing more "Pizza Fridays" on-site.

Don’t Forget to Review Your Contract Rates

One critical thing to remember about your compensation plan is that it's closely tied to the charge-out rates in your contract and how you estimate projects. It's very important that you monitor this on a regular basis to ensure that you are not underselling your work.

One way to do this effectively is to regularly update your Labor Burden Worksheet and adjust your contract rates accordingly. The best business owners out there review this worksheet prior to issuing new contracts and anticipate those employees who will likely see an increase by the time this future project kicks off.

For more information on learning how to use a Labor Burden Worksheet, click here to join the BUILD AND PROFIT SYSTEM.

The Bottom Line on Employee Compensation

Your employees are the lifeblood of your business, and their performance can either help or hinder your ability to succeed.

As a business owner and an employer, your goals for employee management should be to:

Hire the right people for each position in your business

Set them up for success

Ensure they are making a positive contribution and reward them fairly

That means using the right motivators to keep your employees happy and motivated. Doing so often means thinking outside the box to create an overall employee compensation and bonus package with the right mix of taxable and non-taxable incentives to make you a huge differentiator from other general construction firms.

Obviously, wages are the most important thing to the people who work for you, and that component needs to be not just livable but competitive as well. But it's the addition of other benefits and compensation items that can have a profound effect on your team, even if they aren't being utilized to their full capacity.

That means looking at ways to implement other fringe benefits like company gas cards, mileage or tool allowances, and educational growth opportunities and defining clear usage policies to create a robust total compensation package that your team can benefit from without impacting their overall gross income or your bottom line.

Need help defining your company compensation plan? Click below to join the Team Development Program.